28+ reverse mortgage for senior

Search For Information And Products With Us. This form of loan allows borrowers to.

Compass Clock Fall Winter 2018 Publication

Web One of the reverse mortgage rules stipulates that the borrower must not reside elsewhere such as a nursing home or assisted living facility for more than 12.

. No income is required to qualify. Web A reverse mortgage is a loan for homeowners 62 and up with a large amount of home equity. It lets you convert a portion of your homes equity into cash.

Web Reverse mortgages are an innovative way for seniors to fund their retirement by tapping into accrued home equity. Web One of the major differences is a reverse mortgage does not require a monthly payment. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator.

If you know someone who wants to age. Ad Should You Get A Reverse Mortgage On Your Property. Ad Browse Local Reverse Mortgage Lenders And Start Your Online Mortgage Application.

Web A reverse mortgage is a special type of home loan that allows you to convert a portion of the equity in your home into cash says Katie Ross education and. Ad Calculate Fees and Rates for Reverse Mortgages. Reverse mortgage loans allow homeowners to convert their home equity into cash.

Web Reverse mortgages provide a way to add cash flow to a seniors budget. Web Other seniors however may prefer to remain in their current homes as long as possible often referred to as aging in place. Reverse mortgages can be a powerful financial tool in retirement especially as more Americans age in place.

Web A reverse mortgage is a type of loan that homeowners aged 62 and above can apply for. Web General reverse mortgage requirements include the following. Best Reverse Mortgage Companies of 2023.

But the products design today isnt meeting. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. Texas mortgage broker waives reverse mortgage lender fee to assist retirees.

Web A reverse mortgageis a type of loan for homeowners aged 62 and older. Looking For Reverse Mortgage. Senior home equity increased by 226.

The loan is only paid off once you no longer live in the home. Web Reverse mortgages do not require monthly payments but they accumulate fees and interest over time. Certain criteria must be met to.

HomeBridge offers the traditional Home Equity Conversion Mortgage which is the oldest and most popular reverse mortgage product. Explore Top Rated Information. Web 2 days agoOne way seniors can increase their cash flow is by tapping into their housing wealth through a reverse mortgage AAG said.

Seniors who still owe on their mortgages can refinance to a reverse mortgage and. Reverse Mortgages For Seniors. Web If youre 62 or older you might qualify for a reverse mortgage.

Web 1 day agoCompetitive Home Lending. Web Save for Your Future. ALLEN Texas March 15 2023.

Ad While there are numerous benefits to the product there are some drawbacks. To qualify for a traditional mortgage or a home equity line of credit you must have. Web Reverse Mortgages allow people from the age of 60 to convert the equity in their property into cash for any worthwhile purpose.

Be at least 62 years old Have zero delinquencies on any federal debt Own your home free and clear or have 50. The homeowner can borrow money from a lender against the value of their home. Mortgage Loans for Retirees and Seniors.

An Overview Of Reverse Mortgage And How It Works. Web A reverse mortgage is a loan that allows homeowners who are 62 or older borrow against a portion of the equity in their home. A reverse mortgage works.

Ad Looking For Reverse Mortgage For Seniors. To qualify for a reverse mortgage loan you need to have a sufficient amount of home. A reverse mortgage enables you to withdraw a portion of your homes.

Compare The Best Lenders For Reverse Mortgages. Web A reverse mortgage is a type of home loan for seniors ages 62 and older. Ad While there are numerous benefits to the product there are some drawbacks.

Search Now On AllinsightsNet. Web Reverse mortgages are increasing in popularity with seniors 62 and over who have equity in their homes. Ad Find Information Here.

With a reverse mortgage the amount of money you can borrow is based on how much equity you have in your. Mar 15 2023 1645 ET.

June 2016 Dc Beacon By The Beacon Newspapers Issuu

Power Players 2022 Memphis Magazine

Reverse Mortgage Requirements For Senior Homeowners Bankrate

How Is A Reverse Mortgage Beneficial For Senior Citizens

Why A Reverse Mortgage Is Better For Seniors Than A Home Equity Loan

Natalya Hill Senior Mortgage Loan Officer And Reverse Mortgage Planner Fairway Independent Mortgage Corporation Linkedin

How Does A Reverse Mortgage Work For Seniors Goodlife

Sell Homes With A Reverse Mortgage Limits And Challenges

Compass Clock Fall Winter 2018 Publication

Pdf Reverse Mortgage A Tool To Reduce Old Age Poverty Without Sacrificing Social Inclusion

This New Type Of Reverse Mortgage Would Help Retirees Generate Much More Income Marketwatch

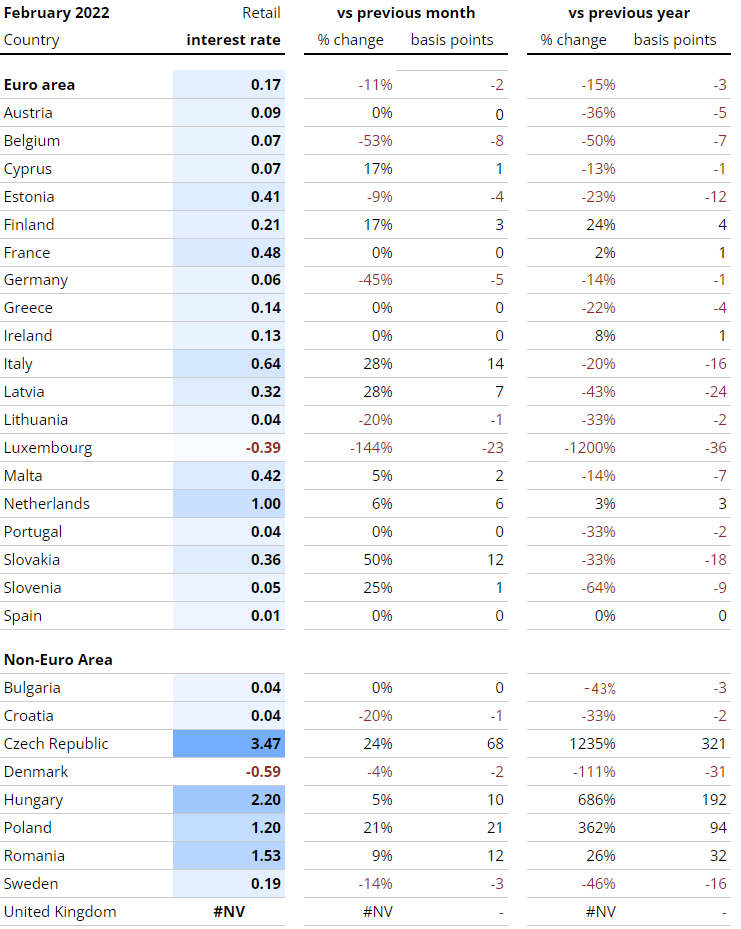

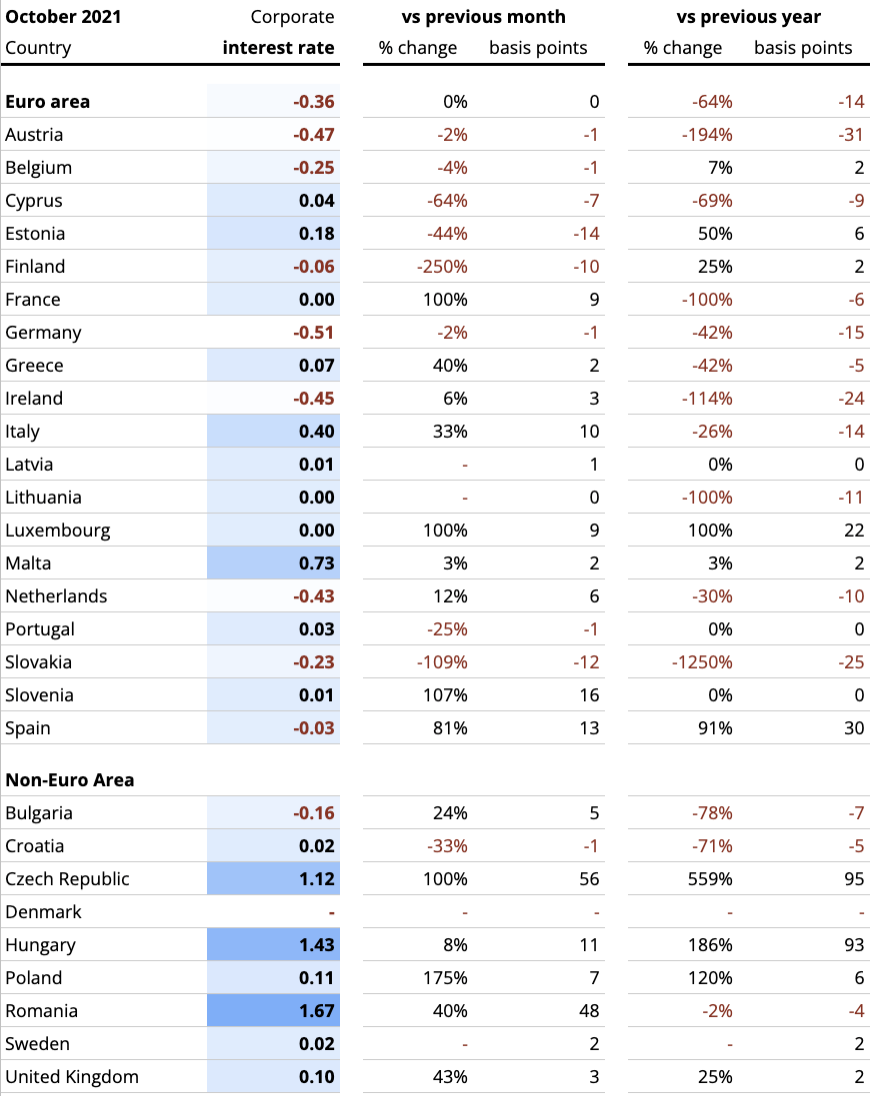

Interest Rates Explained By Raisin

Reverse Mortgage Requirements For Senior Homeowners Bankrate

How Does A Reverse Mortgage Work For Seniors Goodlife

Arvada Press 120822 By Colorado Community Media Issuu

Raisin S Interest Rate Tracker

Reverse Mortgage Stock Photos Pictures Royalty Free Images Istock