Depreciation expense formula

Non-ACRS Rules Introduces Basic Concepts of Depreciation. It has a useful.

Depreciation Formula Examples With Excel Template

Depreciation Cost of asset Residual Value x Annuity factor.

. Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in annual depreciation expenses As for the residence itself the IRS requires you to. Depreciation Expense Number of Units Produced Life in Number of Units x Cost - Salvage Looking at our 10000 asset lets assume that it can produce 500000 units. To calculate the depreciation expense using the formula above.

Depreciation expense Assets cost Assets scrap value Assets useful life. Under this method we transfer the amount of depreciation every. Sinking fund or Depreciation fund Method.

Depreciation represents the allocation of the one-time capital. Companies use the following straight-line depreciation formula. Unit Depreciation Expense Fair Value Residual Value Useful Life in Units.

The DDB rate of depreciation is twice the straight-line method. Example of a Depreciation Expense. Depreciation Expense Total PP.

Periodic Depreciation Expense Unit Depreciation Expense Units Produced. For example an asset with a useful life of five years would have a reciprocal value of 15 or 20. Depreciation Expense Beginning Book Value for Year 2 Useful Life.

The straight-line depreciation method is the easiest to calculate and the annual depreciation amount original net value of assets-estimated residual value service life. Depreciation Expense 4 million 100 million x 25000 0 1000. The purchase price of these hypothetical forklifts is 7000 apiece for a.

Start with the cost of an asset and multiply by the number of units. This method uses the following formula. Following the depreciation expense formula above.

In year one you multiply the cost or beginning book value by 50. Now you can build a depreciation scheduleThe depreciation schedule for. The units-of-production depreciation method calculates the depreciation expense per unit or product.

Depreciation Expense 17000 - 2000 5 3000. You buy a car for 50000. Unit depreciation expense fair.

The formula is as followed. You then find the year-one. DDB Net Book Value - Salvage Value x 2 Useful Life x Depreciation Rate.

Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. The units-of-production method of depreciation does not have a built-in Excel function but is included here because it is a widely used method of depreciation and can be. Lets use a car for an example.

Depreciation Methods Principlesofaccounting Com

How To Calculate Depreciation

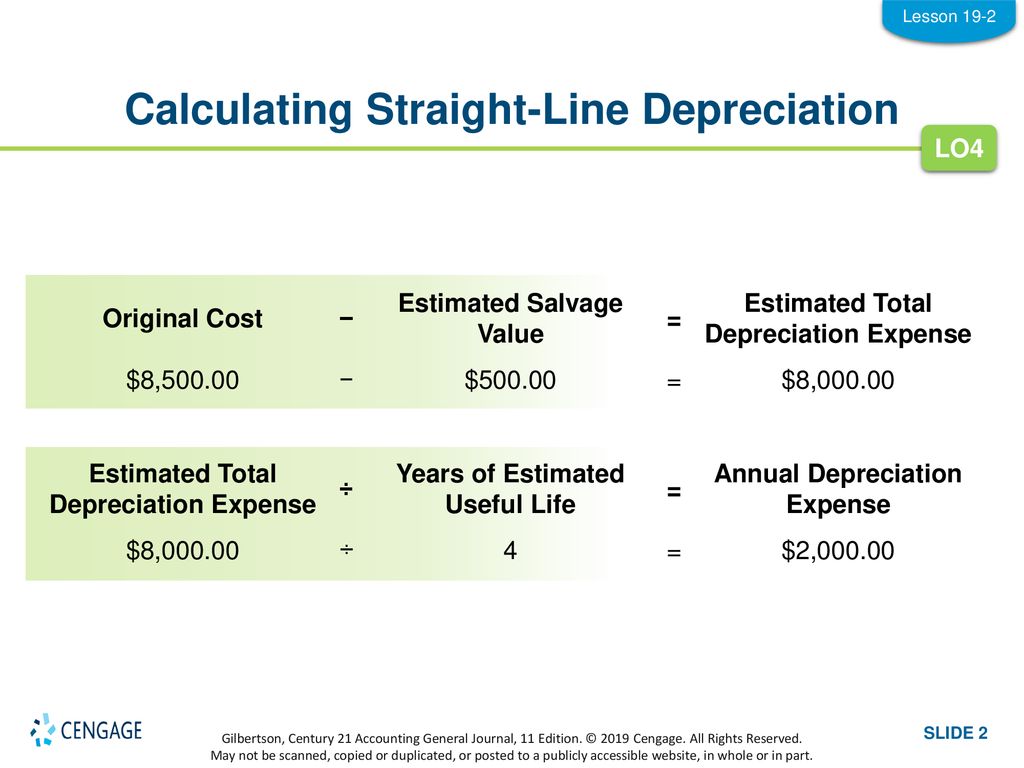

Lesson 19 2 Calculating Depreciation Expense Ppt Download

How To Calculate Depreciation Expense

Annual Depreciation Of A New Car Find The Future Value Youtube

Straight Line Depreciation Formula And Calculator

Depreciation Calculation

Accumulated Depreciation Definition Formula Calculation

Straight Line Depreciation Accountingcoach

Depreciation Formula Calculate Depreciation Expense

Double Declining Balance Depreciation Daily Business

Depreciation Expense Double Entry Bookkeeping

Depreciation Rate Formula Examples How To Calculate

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Schedule Formula And Calculator

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense